Bitcoin, Blockchain and the Mathematics

An Introduction – Understanding the Mathematics of Bitcoin

Business powerhouses that hold the concentrated power to set a market trend have been marching towards the Bitcoin market, more so in a herd. Square Inc. purchased $50 million Bitcoins. Recently Tesla’s investment of $1.5 billion in Bitcoin has fetched mainstream recognition. So, how does it all work? A lot is written about Bitcoins and the digital ledger “Blockchain technology.” However, this article will delve deeper into understanding how it works at the micro-level and the math behind it.

How Does Bitcoin Work?

Bitcoin is a digital currency used for peer-to-peer transactions empowered by blockchain technology, free from any third-party interference. It runs through cryptography using proof-of-work to authenticate the transactions. Blockchain, a digital ledger, forms the genesis through which the Bitcoin ecosystem is fired. The transactions are carried out by encrypted codes that are based on blockchain technology.

Every transaction is recorded on the public ledger, i.e., Blockchain. The Bitcoin wallets assign a unique private key (ensuring anonymity) to each transaction, which acts as proof-of-work linking the transaction with the user who initiated the transaction and hence immutable. The procedure of authentication of these transactions and making a permanent entry on the blockchain is carried through Bitcoin mining. Bitcoin mining involves high-powered computers with specially designed hardware ASIC to solve complex mathematical problems. Bitcoin is the most widely used decentralized cryptocurrency. As 2021 started, the price of Bitcoin reached its all-time high & which continues its upward trek till now. Some crypto experts predicted that the price of Bitcoin will rise more in the coming future. Several investors plan to invest or trade in Bitcoin as the price goes up every day. Suppose you are planning to invest in Bitcoin. The Bitcoin Future is an automated trading platform for Bitcoin & cryptocurrency, which uses a smart trading robot program with an AI-based algorithm. To know more about this, you can check some positive review on Bitcoin Future.

The Math Behind the Bitcoin Protocol

The Bitcoin transactions are carried out through Bitcoin Protocol, which intricately works through a framework of cryptography. This framework prescribes the whole process of mining, processing the Bitcoin transaction, and validating the transaction. The transaction is the heart of the protocol to power an exchange wallet.

Since the process is decentralized, when the transaction is initiated, it connects with every node in the system for validation. So, these nodes form blocks to store data related to the transaction each time a transaction is initiated. To authenticate the new transaction, the nodes must attach a solution called proof-of-work. The node transmits the solution to the ecosystem, which is then transformed into a solved block, thus validating the transaction. This process is repeated for each transaction.

Transactions are carried out through private and public keys. The keys are essential to carry out the transactions using computer-generated hashes and Elliptical Curve Digital Signature Algorithm (ECDSA). A public key of the payee, which is nothing, but an encrypted code linked to his crypto wallet, is fired in the network. Hash is formed using this public key and the user’s last transaction. The initiated transaction needs to be verified, so the sender will log in through the private key to authenticate the transaction.

Furthermore, these transaction details are publicly available but without disclosing the personal details of the users. Hence, these transactions appear as the transaction value in the form of the size they occupy, for instance, 256-bit hash. Now, this hash is computed through the SHA-256 algorithm. Now, this is a digital transaction beyond the bank’s scope, so what if the same transaction is duplicated? Timestamp servers are introduced to avoid this scenario, which displays the transaction as per the time-sequence. This eliminates the complete chance of using the same token twice.

Bitcoin’s Mathematical Problem

Now that the concept of hashes is clear, let’s understand the math behind the ECDSA. ECDSA works through an elliptic curve and finite field, which authenticates and approves the transactions. However, the sole right to build a unique signature still lies with the user who signs in. ECDSA has prescribed two protocols for the sign-in and the authentication. These protocols are nothing but a set of mathematical computations. The sign-in protocol is based on a private key, whereas the verification process is based on a public key. Firstly, let’s understand the elliptic curve.

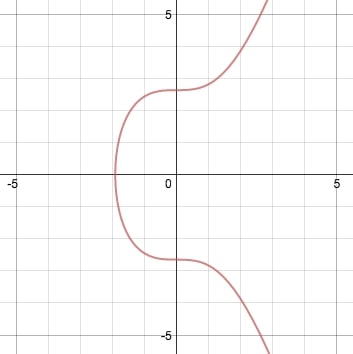

An elliptic curve is expressed in the form of an algebraic equation:

y2 = x3 + ax + b

Where a=0 and b=7

Interestingly, when plotted on the graph, the curve meeting the two non-tangent points will always intersect the third point on the curve. The two other versions are point addition and point doubling.

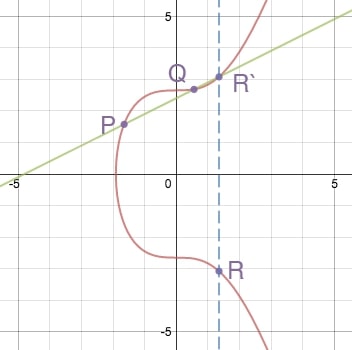

a) Point addition

P +Q = R

It is projected through the third intersecting point R along the x-axis, which includes P and Q.

b) Point doubling

P +P =R

The tangent line can be traced to point P and connected with the point R along the x-axis on the curve itself to plot this.

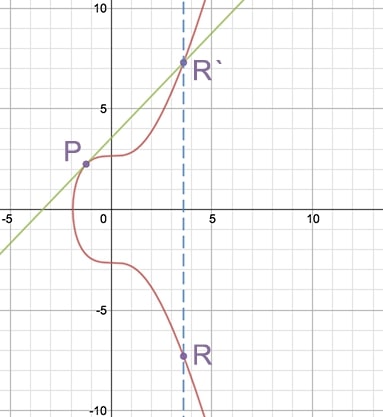

These computations are further utilized in scalar multiplication.

c) Scalar multiplication

R=7P

It is solved using above mentioned two processes

R= 7P

R= P + 6P

R= P + 2(3P)

R= P + 2(P + 2P)

d) Finite Field:

A finite field is the prescribed scope of positive numbers of the computation limited within ECDSA.

Let’s say we compute the remainder following the modulus operator system.

So in the computation of 11/9, the remainder will be 2. Therefore, 11 mod 9 =2

So, 9 is the modulo, and all the results will be within the scope between 0-8

Conclusion

During the Bitcoin transaction, there is a lot of computation taking place in the background, and Bitcoin-based on blockchain technology is dominated by Math.

How to determine if a company is using blockchain technology correctly?

In today’s Digital era, every company needs to effectively utilize blockchain technology. …